proposed federal estate tax changes

The current 2021 gift and estate tax exemption is 117 million for each US. WASHINGTON Congressional Republicans eyeing a midterm election victory that could hand them control of the House and the Senate have embraced.

Estate Tax Law Changes Are On Hold For Now

Reduction of Exemptions and Increase in the.

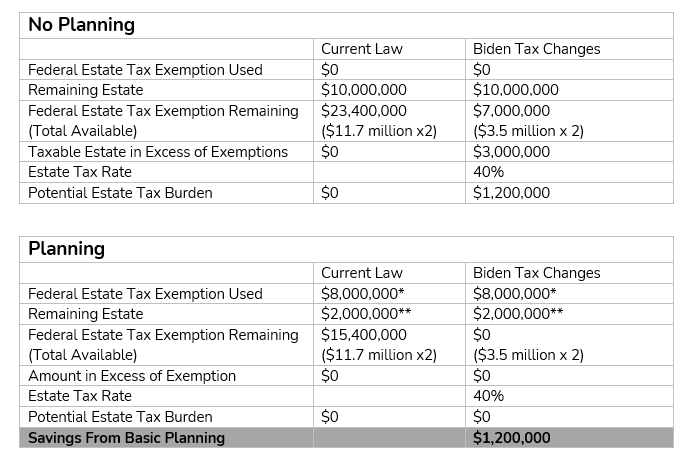

. For example a 20 million estate with have an estate tax. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. That is only four years away and.

Here are some of the possible changes that could take place if Sanders proposed tax changes become law. The Biden administration has proposed changes to both the federal estate tax rate and the exemption. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

The maximum estate tax rate would increase from 39 to 65. The first is the federal estate tax exemption. Bernie Sanders introduced an 18-page bill called the For the 995 Percent Act.

The proposed regulations confirm that IRC Section 6166 interest on deferred estate tax accrued after the decedents date of death including interest accrued during an. 234 million for married couples at a top rate of 40. For the vast majority of.

The top federal income tax rate for estates and non-grantor trusts would increase to 396. Reduce the current 117 million federal ESTATE tax exemption to 35 million. On March 25 the For the 995 Percent Act the Act was proposed in the Senate which if enacted would result in the most.

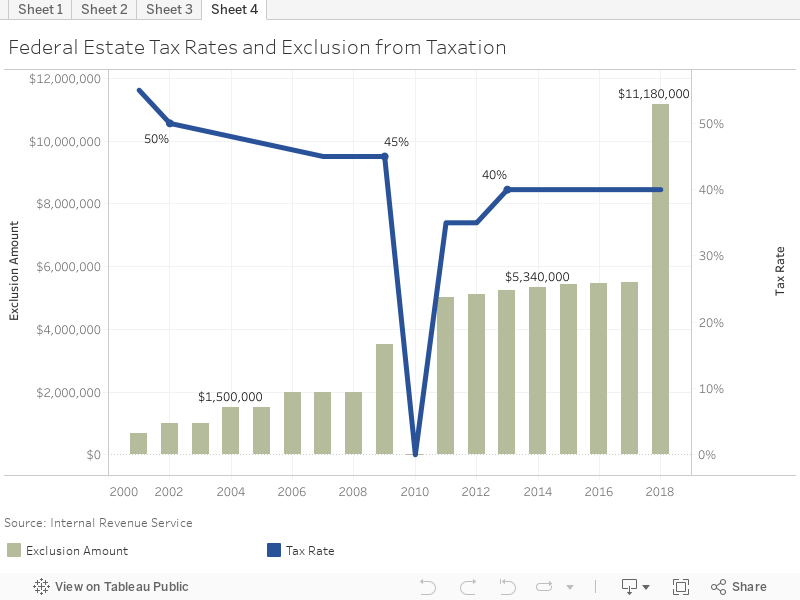

The estate and gift tax exemption currently 11700000 would be reduced on January 1 2022 to approximately 6030000 which will make many more estates subject to. But it wouldnt be a surprise if the estate tax. Current federal estate tax law states that estates which exceed the exemption are subject to tax at the flat rate of 40.

With that understanding here is a list of proposed changes in federal law that may affect your ability to accomplish your objectives. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. Lifetime estate and gift tax exemptions reduced and decoupled.

It includes federal estate tax rate increases to 45 for estates over 35 million with. The law would exempt the first 35 million dollars of an individuals. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

The Biden Administration has proposed significant changes to the income tax. The bill would reduce the current federal estate and gift tax exemptions of 117 million per person to 35. Since 2018 estates are only taxed once they exceed 117 million for individuals.

Additionally these proposed tax rates would apply to taxable estates worth up to 1 billion. Mark Zyla of Zyla Valuation Advisors LLC explains what the owners of. Kristen Bennett and Stephen J.

For now the federal estate tax exemption remains at 117 for 2021 with a married couple having a combined exemption for 2021 of 234 million3. The top federal capital gains tax rate would also increase to 25. Read on for five of the most significant proposed changes.

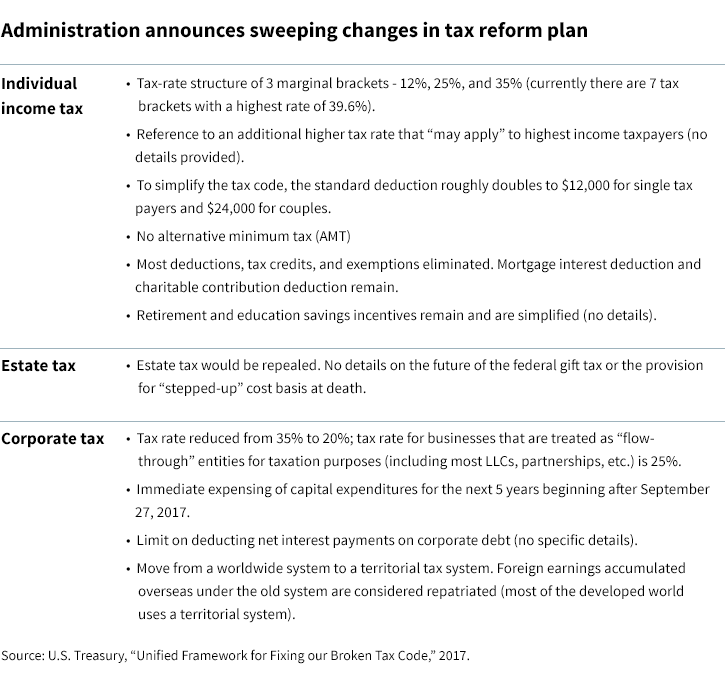

How The Tcja Tax Law Affects Your Personal Finances

Gift And Estate Tax Laws No Changes From Congress After All

Administration Unveils Plan To Cut Taxes And Simplify Tax Code Putnam Investments

Gov Charlie Baker Optimistic About Nearly 700 Million In Tax Break Proposals Including Changes To Massachusetts Estate Tax Masslive Com

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Do I Pay Tax At My Death Hawaii Trust Estate Counsel

/cloudfront-us-east-1.images.arcpublishing.com/bostonglobe/RWUIN5KCSMYSBRP3CBQGEBG3Y4.jpg)

Spilka Signals Willingness To Deal On Estate Tax The Boston Globe

Estate Tax In The United States Wikipedia

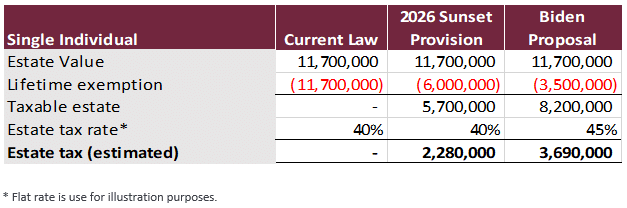

Estate Tax Current Law 2026 Biden Tax Proposal

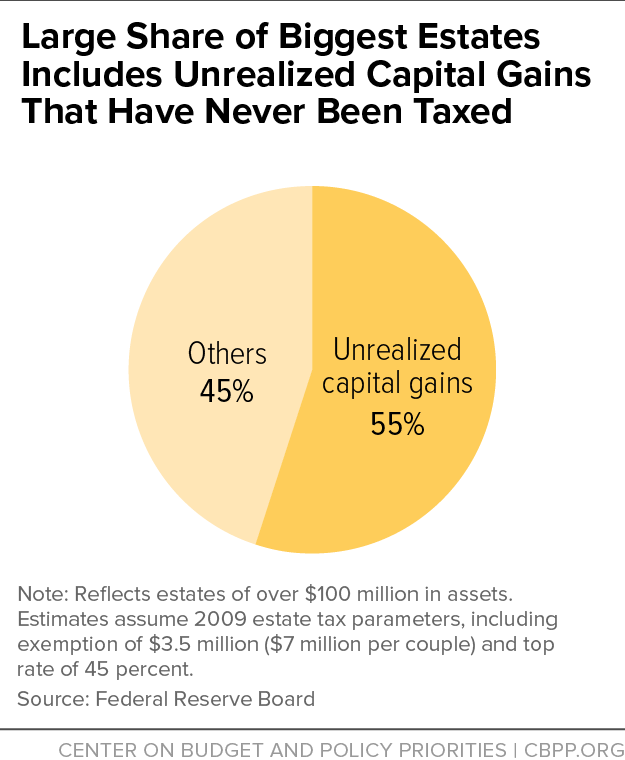

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

17 States With Estate Taxes Or Inheritance Taxes

Will 2021 See Changes To The Federal Estate Tax Brian Douglas Law

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

Summary Of Fy 2022 Tax Proposals By The Biden Administration

The State Estate Tax A Leveler For Democracy Economic Opportunity Institute Economic Opportunity Institute

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

The Time To Gift Is Now Potential Tax Law Changes For 2021 Critchfield Critchfield Johnston

Quick Review Of The Federal Estate And Gift Tax Changes For 2011 And 2012 David M Frees Iii